Nigerian fintech Moniepoint has secured its place as one of Africa’s leading tech companies by reaching "unicorn" status, a term used for privately held firms valued at over $1 billion, after successfully raising $110 million from notable investors like Google and Development Partners International. This funding round, announced Tuesday, marks a pivotal milestone for Moniepoint, which now holds a valuation surpassing the billion-dollar mark for the first time.

Founded in 2015, Moniepoint originally focused on providing financial infrastructure and payment processing solutions for banks and financial institutions across Nigeria. Over the years, it has expanded its offerings, introducing personal banking services and becoming a central player in the African fintech landscape. This recent investment round included backing from current investors, including London-based Development Partners International and Lightrock. New investors like Google's Africa Investment Fund and Verod Capital also joined, underscoring growing confidence in Moniepoint's vision for digital financial services in Africa.

According to the company, the newly raised capital will accelerate its expansion efforts across the continent, allowing Moniepoint to grow its all-in-one platform tailored for African businesses. This integrated platform aims to offer a comprehensive suite of services, including digital payments, banking, foreign exchange (FX), credit facilities, and business management tools. The company hopes to create a one-stop solution for businesses of all sizes, allowing them to manage a wide array of financial needs through a single platform.

Moniepoint has experienced impressive growth, with over 800 million transactions processed monthly, totaling a transaction volume that exceeds $17 billion each month. The fintech’s rapid rise also reflects broader trends in Nigeria, where the population of over 200 million people includes many who still lack adequate access to financial services, creating a significant opportunity for fintech companies to bridge the gap in banking and payments.

Last year, Moniepoint expanded into personal banking, aiming to reach individuals and businesses that traditionally lacked access to financial services. This move aligns with Nigeria's position as Africa’s fastest-growing fintech market, where there is substantial demand for digital banking options.

With this new funding, Moniepoint is poised to scale its operations further, aiming to reach more customers and strengthen its impact on Africa’s financial ecosystem. The company’s success also highlights the growing appeal of African tech startups to global investors, with increased interest from both regional and international firms in recent years. As Moniepoint continues its expansion, it will play a crucial role in enhancing financial inclusion and providing innovative solutions tailored to African markets.

Technology

US Antitrust Push Could Force Google to Sell Chrome

US antitrust lawyers are urging a judge to order Google to sell its Chrome browser, aiming to curb the company's dominance in online search.

Xiaomi Expands in Nigeria with Three New POCO Smartphones

Xiaomi Strengthens Nigerian Market Presence with Latest POCO Devices On November 18, Xiaomi marked a major milestone in Nigeria by launching three new POCO smartphones: the POCO X6 Pro 5G, POCO C75, and POCO C61.

Young Engineers Uganda Wins STEM Trophy at Pan-African Competition

A team of 15 young innovators from Young Engineers Uganda has triumphed at the second Young Engineers Pan-African STEM Competition, held on Saturday, November 16, at Aga Khan Primary School in Tanzania.

Xiaomi Launches Dual-Brand Strategy to Cater to Nigerian Consumers

Xiaomi Nigeria has announced an exciting dual-brand strategy to better serve the diverse needs of Nigerian consumers.

Ugandan Leaders Embark on Digital Training Program in China, Backed by Huawei

In Kampala, Uganda, Prime Minister Rt.

Tesla Recalls 2,431 Cybertrucks Over Faulty Inverter Hardware Issue

Tesla has announced a recall for 2,431 of its 2024 Cybertrucks due to a faulty drive unit inverter, marking the sixth recall for the model this year.

dfcu Bank Wins Gold for Investment Club App at MEA Awards

Kampala, Uganda – At the 2024 Qorus Reinvention Awards – MEA held in Dubai, dfcu Bank earned top honors in the Distribution category, taking home the prestigious Gold award for its innovative Investment Club App.

Starlink Suspends New Subscriptions in Nairobi Due to Overload

Starlink has paused new subscriptions for its residential internet plan in Nairobi and several surrounding areas due to network overload.

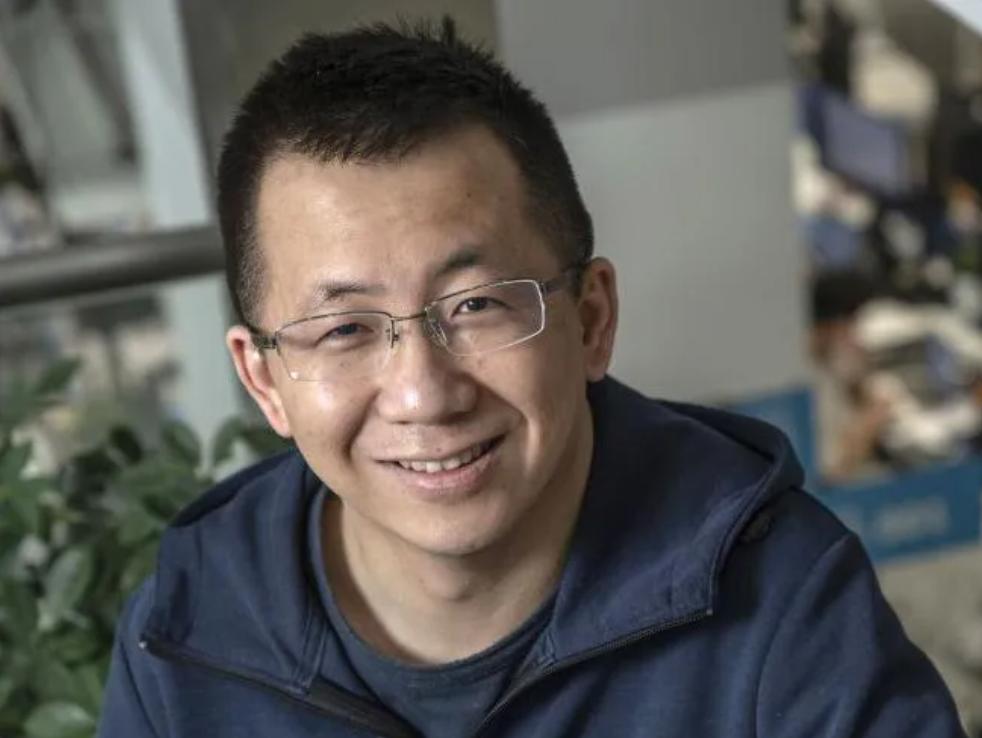

TikTok Founder Becomes China’s Richest as ByteDance Profits Surge

Zhang Yiming, co-founder of TikTok’s parent company ByteDance, has become China’s wealthiest individual, with a personal fortune of $49.3 billion, as estimated by the Hurun Research Institute’s latest rich list.

Google Invests $5.8 Million in AI, Cybersecurity Training Across Africa

In a significant move to support digital skills in Africa, Google has committed $5.8 million to advance foundational training in AI and cybersecurity across Nigeria, Kenya, and South Africa.

Kenya’s New Mobile Tax Compliance Rules Set to Impact Market from 2025

The Communications Authority of Kenya (CA) has announced new regulations, effective January 1, 2025, designed to strengthen tax compliance within the mobile device market.