Equity Group Holdings reported a strong nine-month performance with a profit after tax of Sh. 40.9 billion, marking a 13 percent rise from Sh. 36.2 billion in the same period last year. This increase highlights Equity Group’s continued growth, largely powered by its expanding presence in regions outside of Kenya, where its subsidiaries now contribute 51 percent of the total gross profit.

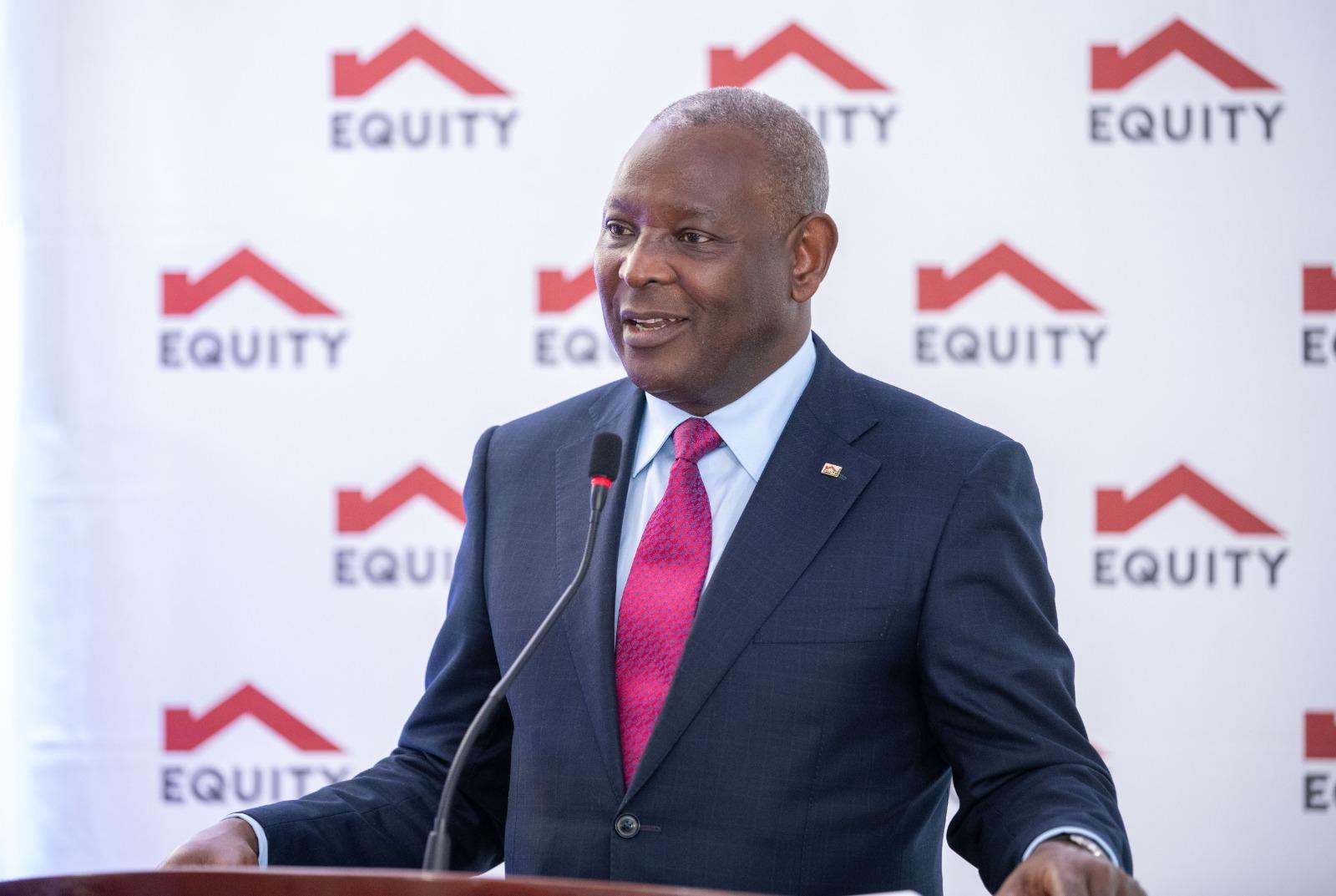

The group achieved this profit from a pre-tax figure of Sh. 51 billion, representing an 11 percent improvement over the prior year. Dr. James Mwangi, Equity Group's managing director and CEO, attributed much of this growth to the performance of the bank’s subsidiaries outside Kenya. Notably, the Equity BCDC unit in the Democratic Republic of Congo (DRC) has played a critical role in driving these results. Additionally, nearly half of Equity’s overall balance sheet, or 48 percent, is now located outside of Kenya, underscoring the group's regional growth strategy.

During the period under review, customer deposits rose by 9 percent to Sh. 1.32 trillion, reflecting the group's ability to attract and retain customer trust and investment. Total assets saw a slight increase, reaching Sh. 1.7 trillion, maintaining the growth trajectory witnessed in recent years. This steady rise follows a significant 24 percent growth in assets in the previous period, from Sh. 1.4 trillion in 2022 to Sh. 1.7 trillion in 2023.

While net loans decreased by 5 percent to Sh. 800.1 billion, the bank reduced its loan loss provision by 33.2 percent, bringing it down to Sh. 12.7 billion. This reduction reflects an improvement in the quality of its loan portfolio. On the expense side, operating costs rose by 7.4 percent, totaling Sh. 90.7 billion, while operating income saw an 8.7 percent increase, reaching Sh. 141.7 billion.

Dr. Mwangi emphasized the bank’s commitment to financial inclusion, noting that Equity has developed robust systems to support customer success. "We have built a model where everyone has access to financial opportunities, breaking barriers that previously excluded many from economic activities," he explained.

He further highlighted East Africa’s potential, calling it one of the world’s fastest-growing regions with an average GDP growth of 5.6 percent. Dr. Mwangi expressed optimism about Equity Group’s future in this vibrant market, seeing immense opportunities for sustained growth and expansion.

Business

Access Bank Dismisses Claims of ₦500m Missing from Customer's Account

Access Bank has firmly denied allegations made by popular social media influencer Vincent Martins Otse, also known as VeryDarkMan, about ₦500 million allegedly disappearing from a customer’s account.

Gold ETFs See Surge in Demand as Prices Hit Record Highs

Inflows into gold exchange-traded funds (ETFs) are expected to rise sharply as Western investors increase exposure to the precious metal.

NNPCL Seeks Court to Dismiss Case Against Dangote Refinery Deal

The Nigerian National Petroleum Company Limited (NNPCL) has requested the court to dismiss a lawsuit involving Lasisi Import, a company challenging aspects of the Dangote Refinery agreement.

COP29 in Baku: Calls for Climate Justice and Equitable Transition

The 29th UN Climate Change Conference (COP29) in Baku, Azerbaijan, brought together over 70,000 delegates from 170 countries, including world leaders and representatives from more than half of the UN's member nations.

President Akufo-Addo Appoints Herbert Krapa as Energy Minister

Ghana’s President, Nana Akufo-Addo, has appointed Herbert Krapa as the substantive Minister for Energy, effective 19th November 2024.

CBK Updates Banknotes With New Security Features and Signatures

The Central Bank of Kenya (CBK) has introduced updates to various Kenyan banknotes to enhance their security and maintain their integrity.

Jospong Rice Launch Boosts Ghana’s Push for Local Food Security

The Asian African Consortium (AAC), part of the Jospong Group, has introduced Jospong Rice, a new locally grown and processed rice aimed at reducing Ghana’s dependence on imports.

Absa Kenya Reports 20% Profit Growth, Hits Ksh.14.7B in Q3 2024

Absa Bank Kenya's Profit after Tax increased by 20% to Ksh.14.7 billion in the third quarter of 2024.

Dangote Seeks Billions to Boost Crude Supply for $20B Refinery

Africa’s richest man, Aliko Dangote, is seeking billions of dollars to secure crude oil supplies for his $20 billion refinery in Lagos.

Nigeria's Inflation Surges to Over 33% in October Amid Reforms

Nigeria's inflation rate climbed to over 33% in October, according to government data, marking a significant economic challenge for the country.

German Desk Launch Strengthens Trade Ties Between Europe and East Africa

Equity Group Holdings Plc, in partnership with DEG – Deutsche Investitions- und Entwicklungsgesellschaft mbH, has launched the German Desk – Financial Support and Solutions for East Africa.

Access Bank UK Acquires Majority Stake in Afrasia Bank, Mauritiu

Access Holdings has announced that Access Bank United Kingdom (UK) has successfully signed an agreement to acquire a majority stake in Afrasia Bank Limited, the fourth-largest bank in Mauritius by assets.

NNPC, Dangote Refinery Ink 10-Year Gas Supply Deal to Boost Output

The Dangote Refinery’s push to increase its daily production of 650,000 barrels has gained new momentum with the signing of a major gas supply agreement with NNPC Gas Marketing Limited (NGML), a subsidiary of the Nigerian National Petroleum Company (NNPC) Limited.

Nigeria Seeks $10 Billion Private Investment to Boost Power Sector

The Nigerian government plans to attract $10 billion from the private sector to strengthen the country’s power infrastructure over the next five to ten years.

UBA Appoints Henrietta Ugboh as New Independent Non-Executive Director

The United Bank for Africa Plc (UBA) has appointed Henrietta Ugboh as an independent non-executive director, bringing her extensive banking experience to its board.